Mc Hammer Here We Go Again

- Editors' Pick

- REITs

Here We Go Over again

Nov. 27, 2021 x:00 AM ET TCN, EQIX, KKR, BX, DBRG, DLR, AMT, CONE, Pine, SQFT, AHT, SOHO, PEI, GPMT, NYMT, REXR, SVC, VNQ, RQI, RNP, IYR, XLRE, RFI, KBWY, SCHH, NRO, FREL, SRVR, JRS, DRN, USRT, ICF, RWR, DRV, URE, SRS, SEVN, FRI, REK, PSR, BBRE, PPTY, VRAI, IARAX 10 Comments 49 Likes

Summary

- U.Southward. equity markets declined on a volatile Thanksgiving calendar week every bit concerns over an emerging COVID variant triggered a fresh moving ridge of economic restrictions and travel restrictions across Europe and Asia.

- Capping-off the choppy week with the worst single-twenty-four hours reject since February, the S&P 500 ended the week lower by 2.1%. Mid-Caps and Pocket-size-Caps dipped over three% while oil plunged 8%.

- Buoyed by strong performance across the "essential" holding sectors - housing, technology, and logistics - real estate equities more often than not held their ground, but COVID-sensitive sectors were slammed.

- Renewed uncertainty over the outlook for growth, inflation, and interest rates comes equally the BEA reported this calendar week that consumer prices in the U.s. soared at the fastest rate in 31 years in October.

- Chiefly, the U.S. housing manufacture - which has been a critical source of strength throughout the pandemic - appears to exist picking up steam however again following a summer slowdown.

- This thought was discussed in more than depth with members of my individual investing community, Hoya Uppercase Income Builder. Learn More »

Finnbarr Webster/Getty Images News

Real Estate Weekly Outlook

U.S. equity markets declined on a volatile Thanksgiving calendar week as concerns over an emerging COVID variant triggered a fresh wave of economic restrictions and travel restrictions across Europe and Asia. The typically uneventful holiday calendar week was anything but repose, outset with the renomination of Federal Reserve Chair Jay Powell, continued with a barrage of economic data that included the highest inflation print in 31 years, and ended with a historic 1-mean solar day article sell-off driven by the Omicron COVID variant.

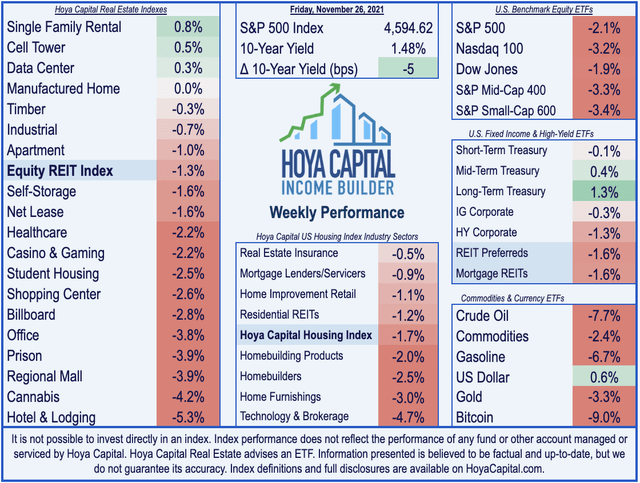

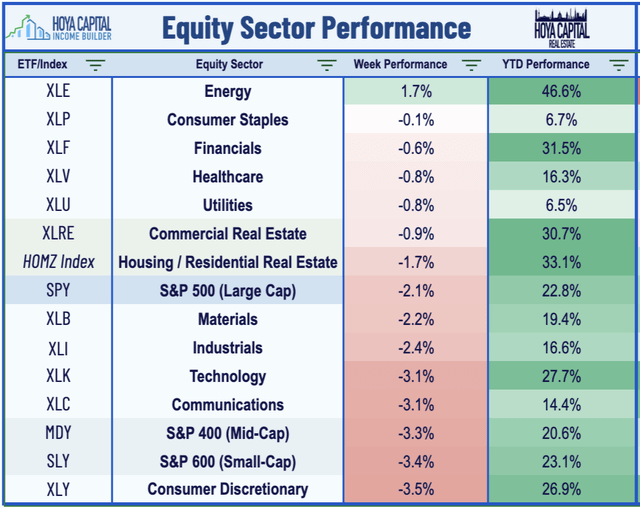

Capping off the choppy week with the worst single-solar day decline since February, the South&P 500 (SPY) ended the week lower by 2.1% while the Mid-Cap 400 (MDY) dipped iii.3% and the Minor-Cap 600 (SLY) declined 3.iv%. Buoyed past strong functioning across the "essential" property sectors - housing, technology, and logistics - real estate equities held their ground every bit the Equity REIT Index ended the week off by 1.3% with iv-of-xix property sectors in positive territory while the Mortgage REIT Alphabetize finished lower by ane.six%.

Volatility across equity markets was rather tame compared to the extreme moves seen in global article markets as the combination of COVID concerns and the release of oil from the Strategic Petroleum Reserve sent crude oil prices to their largest one-twenty-four hour period turn down since April 2020. Sovereign yields as well recorded 1 of their largest intra-week swings since the pandemic as the ten-Year Treasury Yield soared higher up one.lxx% following the announced renomination of Fed Chair Powell as investors priced-in higher certainty of rate hikes by mid-2022 before plunging to end the week beneath i.fifty%.

Real Estate Economic Data

Below, we recap the most of import macroeconomic information points over this past calendar week affecting the residential and commercial real estate marketplace.

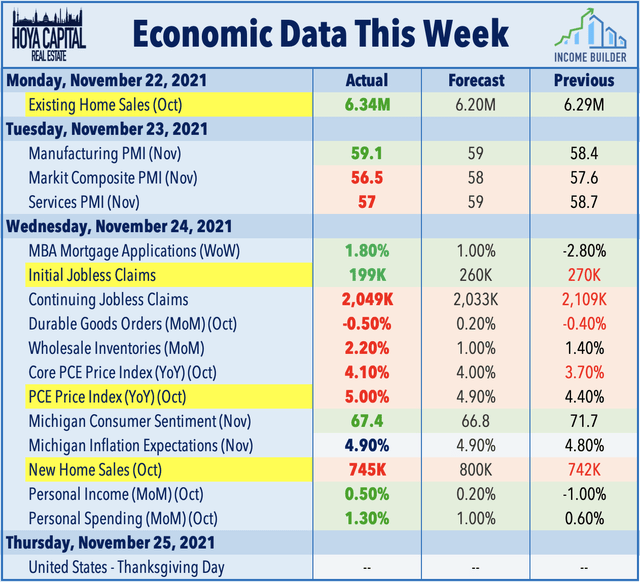

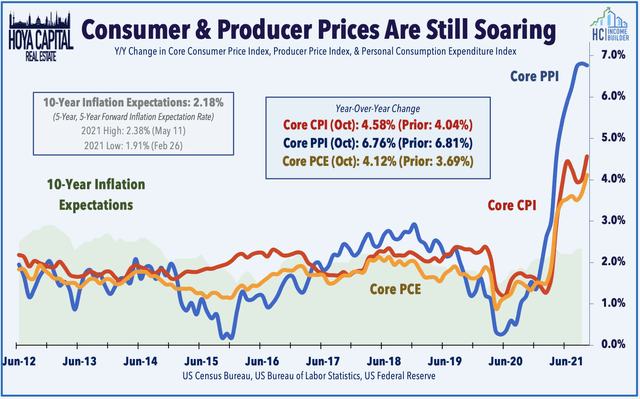

The reimposition of economic restrictions beyond several major economies across Europe and Asia introduces fresh uncertainty over the much-debated outlook for inflation, which comes as the BEA reported this calendar week that consumer prices in the US connected surging in Oct with the PCE Price Index - the Fed's "preferred" measure of inflation - ascension more than 5% from terminal year - the highest rate of inflation in more than three decades. Driving the gains was a thirty% year-over-twelvemonth surge in energy prices and a 5% increase in nutrient prices - bug that have resulted in a historic plunge in consumer confidence metrics since late Baronial which remained at decade-lows in this week'due south report from the Academy of Michigan.

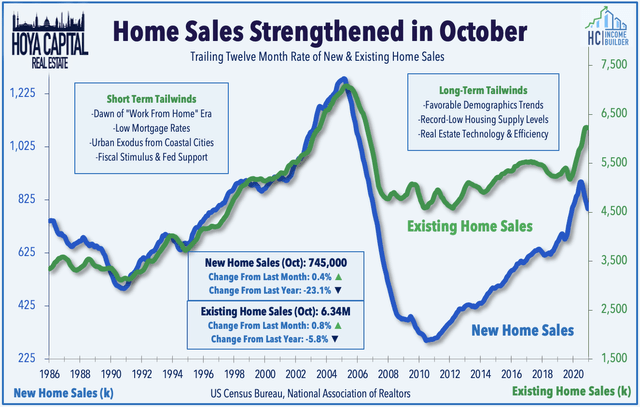

Apart from another historically hot inflation study, the pre-Thanksgiving avalanche of economic data was by and large meliorate-than-expected as weekly Initial Jobless Claims cruel sharply while Personal Income and Spending data as well topped estimates. Chiefly, the U.Due south. housing industry - which has been a critical source of strength throughout the pandemic - appears to be picking up steam yet once again following a summertime slowdown. New Dwelling house Sales rose to the highest level in six months while Existing Sales rose to 9-month highs. Last calendar week, Homebuilder Confidence rose to the highest since May 2020.

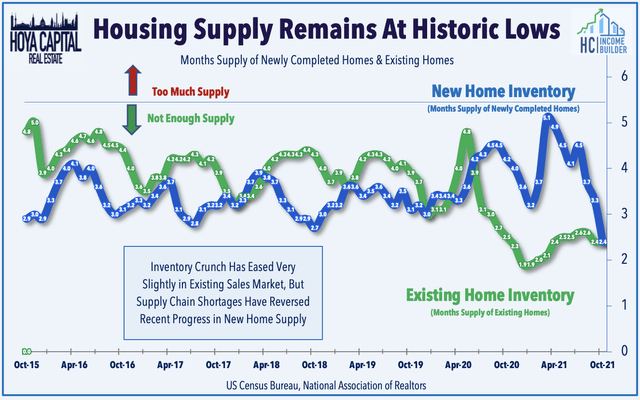

The resilience in domicile sales comes despite record-low inventory levels with the number of unsold homes failing 12% year-over-twelvemonth to ane.25 million – equivalent to ii.iv months of the monthly sales step. Properties typically remained on the marketplace for just 18 days in October, while 82% of homes sold in Oct 2021 were on the marketplace for less than a month. Naturally, with historically low supply and robust need, home values and rental rates continued their relentless ascent in October according to fresh data from ApartmentGuide, which reported that apartment rents for 1-bedroom units are 20% higher than last year while 2-bedroom units have risen 17%.

Equity REIT Week In Review

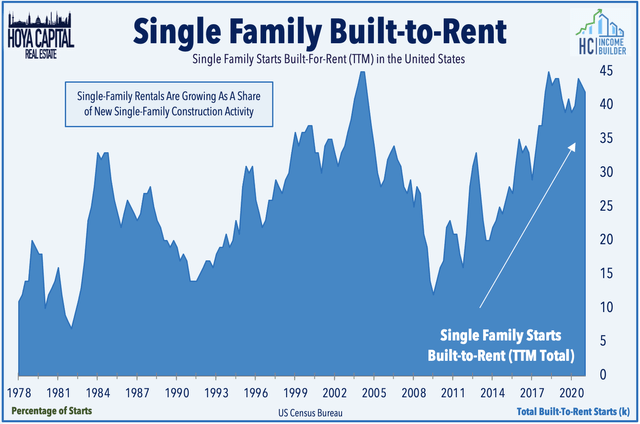

Single-Family Rentals: Speaking of soaring rents, Tricon Residential (TCN) - the fourth-largest owner of single-family homes in the The states - appear this week that it at present has 3,000 additional rental units in its structure pipeline through its partnerships with home builders. The communities are under evolution in Tricon'south existing single-family unit rental investment vehicles and Homebuilder Direct JV, and are being congenital by a number of national and regional homebuilders including four of the acme 25 largest homebuilders. We expect SFR REITs and other institutional SFR operators to account for a growing share of new home purchases directly from homebuilders, which should more than starting time headwinds on demand related to affordability constraints.

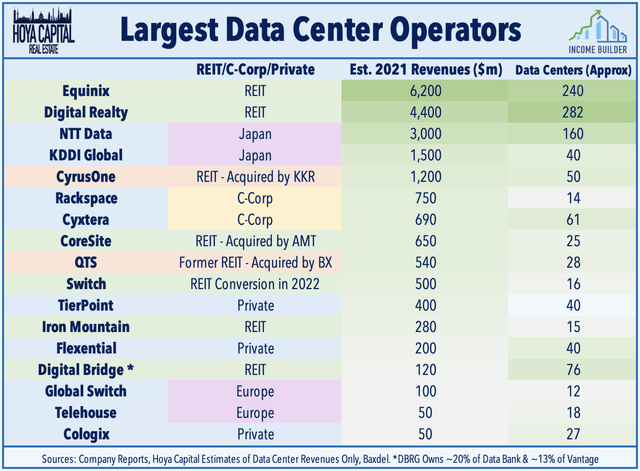

Data Center: As anticipated, we likewise saw confirmation that the data center Chiliad&A nail is far from complete. Equinix (EQIX), KKR & Co. (KKR) and Blackstone (BX) are said to be among buyers because bids for data centre operator Global Switch - which operates xiii facilities across Europe, Asia, and Commonwealth of australia. Digital Realty (DLR) and DigitalBridge (DBRG) have too reportedly expressed preliminary involvement for Global Switch. In Merger Madness, we noted that Digital Realty and Equinix have been uncharacteristically tranquility this twelvemonth on the Chiliad&A front despite sitting on a mountain of "dry powder" as the three smaller data middle REITs - CoreSite (COR), CyrusOne (CONE), and QTS Realty - were all scooped-up by competitors.

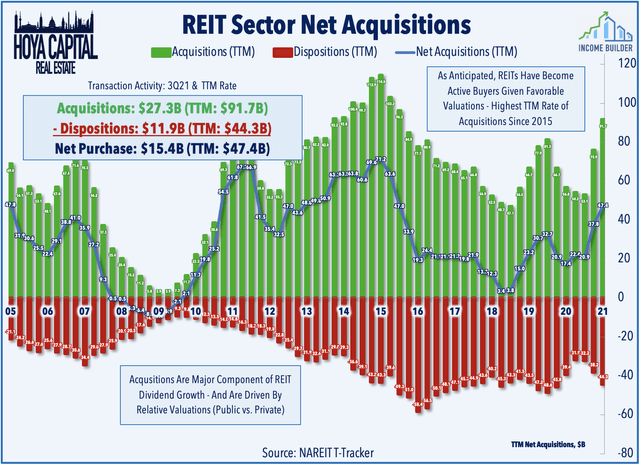

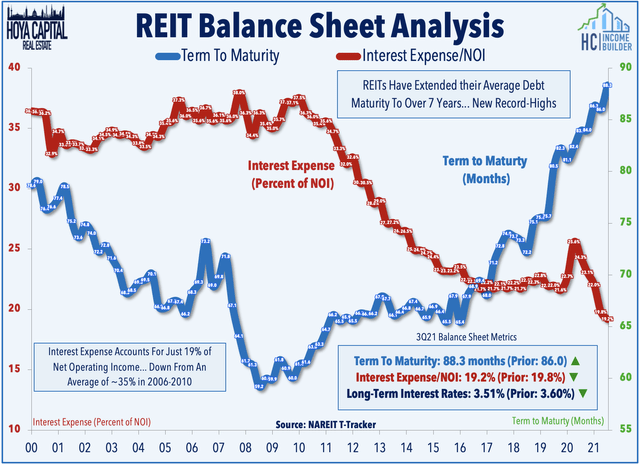

This calendar week, we published State of the REIT Nation, which discussed how premium valuations accept revived the "animal spirits" and sparked a much-needed moving ridge of Yard&A and IPO activity which has facilitated accretive external growth. With six completed IPOs and four more on the way, 2021 will get down every bit the most active year for REIT IPOs since 2013. At the same fourth dimension, several mega-sized non-traded REITs accept scooped upwards public REITs. REITs have caused nearly $50B in internet avails over the past year - the largest expansion in the asset base since 2015. External growth may be just getting started as REIT balance sheets - and access to uppercase - accept never been stronger.

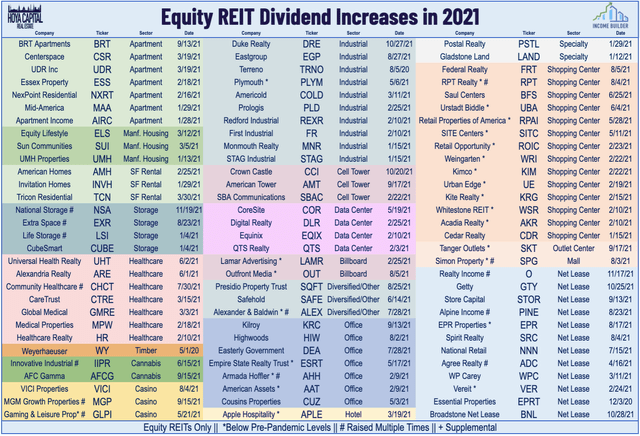

Internet Lease: We too saw ii more REIT dividend increases this week equally small-cap net lease REIT Alpine Income Property Trust (PINE) hiked its dividend for the 3rd fourth dimension this year, while Presidio Property (SQFT) bumped its dividend for the fourth time this yr. In our State of the REIT Nation study, we discussed how despite the 120 REIT dividend increases this year, the 3rd quarter total dividend payouts were notwithstanding 20% beneath the pre-pandemic third quarter of 2019. With FFO growth significantly outpacing dividend growth, REIT dividend payout ratios remained at only 67% in Q3, indicating that REITs are poised for another large year of dividend increases in 2022 absent COVID-related setbacks.

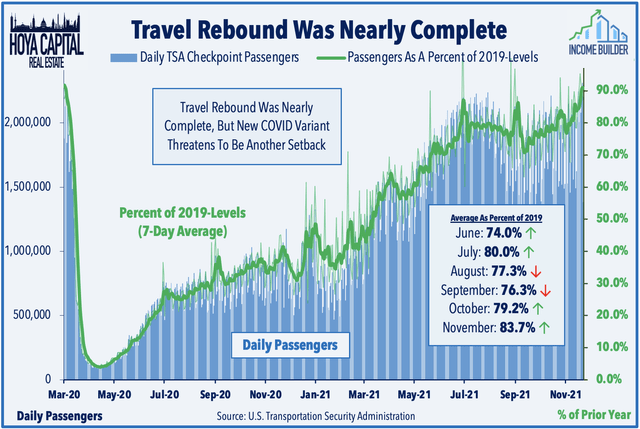

Hotels: While residential and technology REITs provided upside support to the REIT index this week, there was notable weakness across COVID-sensitive REIT sectors - retail, function, and hotels - with thirty equity REITs lower past more than 5% on the week including Ashford Hospitality (AHT), which declined most 10% despite announcing that information technology plans to go current on its accrued preferred dividends after having deferred cumulative payments over the by six quarters. AHT, which has reported improving operating metrics, was 1 of a small scattering of REITs along with Sotherly Hotels (SOHO) and Pennsylvania REIT (PEI) that however had their preferred dividends suspended.

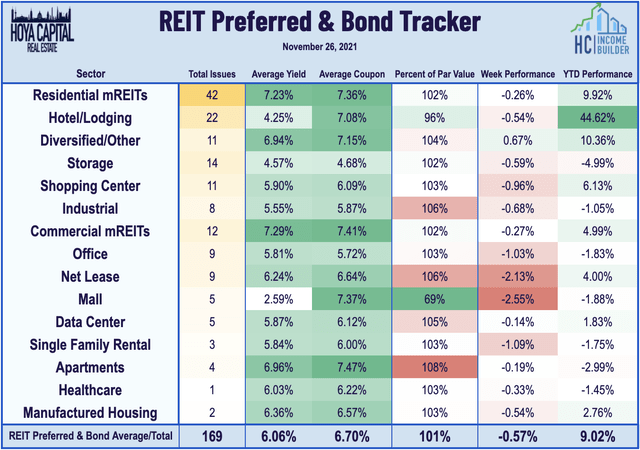

REIT Preferreds & Capital letter Raising

REIT Preferred stocks declined 0.57% this calendar week, on average, but remain higher by 9.02% on a toll-return basis with full returns of roughly 14%. This calendar week, Granite Point Mortgage (GPMT) priced its first commutation-traded preferred issue - a vii.00% Series A Fixed-to-Floating Charge per unit Cumulative Redeemable Preferred Stock with a $25/share liquidation preference, which information technology will list on the NYSE under symbol GMPT PrA. Internet proceeds will be used for the partial repayment of its 8.00% senior secured term loan facility. Also this week, New York Mortgage Trust's (NYMT) new seven.000% Series G Cumulative Redeemable Preferred - began trading on NASDAQ under symbol NYMTZ.

Over in the bond markets this week, Digital Realty announced that information technology extended its existing global revolving credit facility from $2.35 billion to $3.0 billion, and the maturity date was extended past three years to January 2027. Elsewhere, S&P affirmed its BBB Long-Term Issuer credit rating for Rexford Industrial (REXR) but lowered its credit rating on Service Backdrop (SVC) to B+ from BB-. In our Land of the REIT Nation study, nosotros analyzed how REITs take used lower rates and plentiful access to debt capital markets to extend their debt maturities to over vii.3 years and to lower their average long-term interest charge per unit from 3.60% to iii.51% over the terminal quarter.

2021 Performance Check-Up

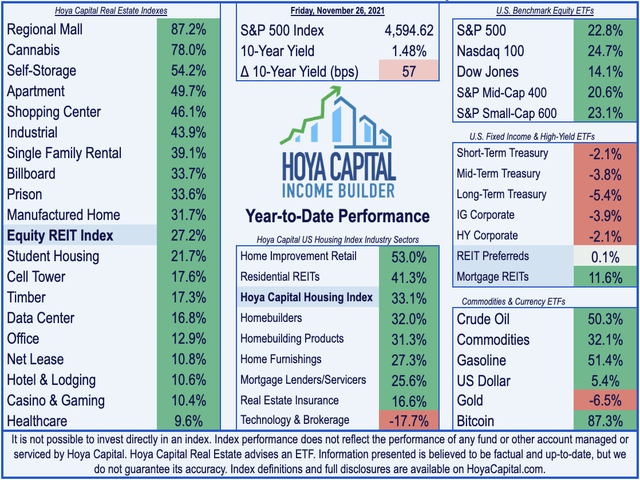

With just five weeks remaining in 2021, Equity REITs are now higher by 27.two% this year on a price return basis while Mortgage REITs have gained 11.6%. This compares with the 22.8% advance on the Southward&P 500 and the 20.6% gain on the S&P Mid-Cap 400. Led by the residential and retail property sectors, all nineteen REIT sectors are at present in positive territory for the year, while on the residential side, seven of eight sectors in the Hoya Capital letter Housing Index are also higher. At 1.48%, the 10-year Treasury yield has climbed 57 basis points since the offset of the yr and is 96 ground points in a higher place its all-fourth dimension endmost low of 0.52% concluding Baronial, but nevertheless 177 basis points beneath its 2018 peak of 3.25%.

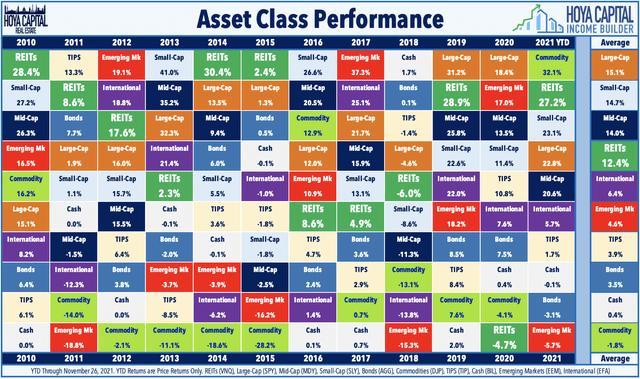

Amidst the 10 major asset classes, REITs are again the 2d-best performing nugget class this year, trailing only the Commodities (DJP) complex. REITs are also outpacing Large-Caps and Mid-Caps well as international stocks and bonds. Despite the rough 2020 in which REITs were the worst-performing asset class, REITs are still the 4th best-performing asset classes since the start of 2010, producing average annual total returns during this time of 12.iv%. REITs just slightly lag Pocket-sized-Cap, Mid-Cap, and Large-Cap equities over this time, producing superior full returns to Bonds (AGG), TIPS (TIP), Commodities, Emerging Markets (EEM), and International (EFA) stocks.

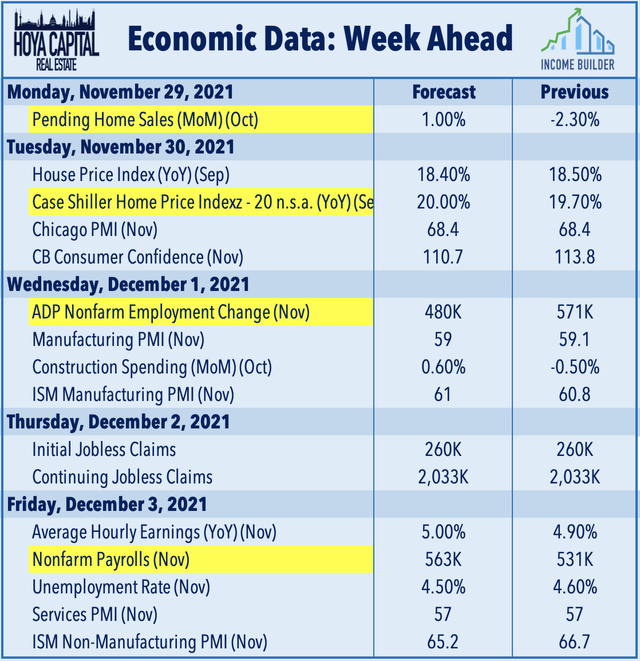

Economic Agenda In The Week Ahead

Employment data highlights the economical calendar in the week ahead, headlined by ADP Employment data on Wednesday, Jobless Claims on Thursday, and the BLS Nonfarm Payrolls study on Fri. Economists are looking for job growth of 563K in November following last month's better-than-expected employment growth of 531K and for the unemployment rate to tick lower to 4.5%. We'll likewise meet a flurry of housing information every bit well with Pending Home Sales information on Mon, Case Shiller Home Price Index data on Tuesday, and Construction Spending data on Wednesday.

For an in-depth analysis of all real estate sectors, be certain to check out all of our quarterly reports Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Function, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Upper-case letter Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to whatsoever long positions listed below, Hoya Uppercase is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Alphabetize definitions and a consummate list of holdings are bachelor on our website.

Introducing Hoya Capital Income Architect

We're excited to announce the launch ofHoya Capital Income Builder- the new premier income-focused investing service. Whether your focus is High Yield or Dividend Growth, we've got yous covered with actionable investment enquiry and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%. Start your Costless Ii-Week Trial Today!

Income Architect focuses on real income-producing asset classes that offer the opportunity for diversification, monthly income, upper-case letter appreciation, and inflation hedging. Members receive complete early on access to our articles forth with exclusive income-focused model portfolios and trackers.

This article was written by

Build sustainable portfolio income with premium dividend yields up to 10%.

High Yield • Dividend Growth •Income. Visit www.HoyaCapital.com for more data and important disclosures. Hoya Capital Research is an affiliate of Hoya Upper-case letter Real Estate ("Hoya Uppercase"), a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut. Founded with a mission to make existent manor more than accessible to all investors, Hoya Uppercase specializes in managing institutional and private portfolios of publicly traded existent estate securities, focused on delivering sustainable income, diversification, and attractive full returns.

Collaborating with ETF Monkey, Retired Investor, Gen Blastoff, Alex Mansour,The Dominicus Investor,and Philip Eric Jonesfor Marketplace service -Hoya Capital Income Architect.

Nada on this site nor any commentary published past Hoya Capital is intended to exist investment, tax, or legal advice or an offer to buy or sell securities. Neither the information, nor whatever opinion, contained on this website or any published commentary by Hoya Capital letter constitutes a solicitation or offering past Hoya Capital or its affiliates to buy or sell any securities, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, buy, or sale would exist unlawful under the securities laws of such jurisdiction. No representation or warranty is fabricated as to the efficacy of any particular strategy or fund, or the actual returns that may be achieved.

Investing involves risk. Loss of primary is possible. Investments in real estate companies and/or housing industry companies involve unique risks. Existent estate companies, including REITs, may accept limited fiscal resources, may trade less oft and in limited volume, and may be more than volatile than other securities. Many factors may affect existent estate values, including the availability of mortgages and changes in interest rates. Real estate companies are also subject to heavy greenbacks flow dependency, defaults by borrowers, and self-liquidation. The housing industry tin be significantly affected by the existent manor markets. Compared to large-cap companies, small and mid-capitalizations companies may be less stable and their securities may exist more volatile and less liquid.

There are also unique risks associated with investing in ETFs. Shares may be bought and sold in the secondary market at market prices and are non individually redeemed from the Fund. Brokerage commissions volition reduce returns. Although it is expected that the marketplace toll of an ETF will guess the Fund's NAV, in that location may be times when the market price of an ETF is more than the NAV intra-day (premium) or less than the NAV intra-twenty-four hour period (disbelieve) due to supply and need of the ETF or during periods of market volatility.

Earlier acquiring the shares of an ETF, it is your responsibility to read the fund'southward prospectus. The prospectus to the ETFs in which Hoya Capital advises are available at www.HoyaETFs.com.

An investor cannot invest directly in an index. Index performance does not reverberate the deduction of any fees, expenses, or taxes. The information and whatever alphabetize data presented exercise not reflect the performance of any fund or other strategies or accounts managed or serviced by Hoya Upper-case letter, and at that place is no guarantee that investors will feel the blazon of performance reflected.

Data quoted represents past performance, which is no guarantee of future results. The views and opinions in all published commentary are equally of the date of publication and are subject to change without notice. There is no guarantee that any historical tendency illustrated will be repeated in the future, and there is no mode to predict precisely when such a trend will begin.

Commentary and information are believed to be accurate, merely nosotros cannot guarantee information technology's accurateness. Nosotros practice not stand for that it is a consummate analysis of all factors and risks. It should not be relied upon equally the sole source of suitability for any investment. Delight consult with your investment, taxation, or legal adviser regarding your individual circumstances earlier investing.

Decisions based on information contained on this site or any commentary published by Hoya Majuscule are the sole responsibility of the reader, and in commutation for using this website or reading whatsoever published commentary, the reader agrees to hold Hoya Capital harmless against whatever claims for damages arising from any decisions that the reader makes based on such data.

Hoya Capital has no business relationship with any company discussed/mentioned. Hoya Capital never receives compensation from whatever company discussed/mentioned. Hoya Upper-case letter, its affiliates, and/or its clients and/or its employees may hold positions in securities or funds discussed on this website and our published commentary. A complete list of holdings is bachelor and updated at www.HoyaCapital.com.

Disclosure: I/we have a beneficial long position in the shares of RIET, HOMZ, RIET, DLR, EQIX, GPMT, TCN, NYMT, Pine, REXR either through stock ownership, options, or other derivatives. I wrote this article myself, and information technology expresses my ain opinions. I am not receiving bounty for it (other than from Seeking Alpha). I accept no account with any company whose stock is mentioned in this article.

Additional disclosure: This is an abridged version of the total study published on Hoya Capital letter Income Builder on November 26th.

Hoya Uppercase Existent Estate ("Hoya Capital") is a research-focused Registered Investment Advisor headquartered in Rowayton, Connecticut. Founded with a mission to brand existent manor more accessible to all investors, Hoya Capital specializes in managing institutional and individual portfolios of publicly traded real estate securities, focused on delivering sustainable income, diversification, and attractive total returns. A complete discussion of important disclosures is available on our website (world wide web.HoyaCapital.com) and on Hoya Capital's Seeking Blastoff Profile Page.

Cypher on this site nor any published commentary by Hoya Uppercase is intended to be investment, tax, or legal communication or an offer to purchase or sell securities. Information presented is believed to be factual and up-to-date, just we practise not guarantee its accuracy and should not be considered a complete discussion of all factors and risks. Data quoted represents by functioning, which is no guarantee of future results. It is non possible to invest directly in an alphabetize. Index operation cited in this commentary does not reflect the operation of whatsoever fund or other account managed or serviced by Hoya Majuscule Existent Estate.

Investing involves run a risk. Loss of principal is possible. Investments in companies involved in the real estate and housing industries involve unique risks, as exercise investments in ETFs, mutual funds, and other securities. Please consult with your investment, tax, or legal adviser regarding your individual circumstances before investing. Hoya Majuscule, its affiliate, and/or its clients and/or its employees may agree positions in securities or funds discussed on this website and our published commentary. A complete list of holdings is available and updated at world wide web.HoyaCapital.com.

Source: https://seekingalpha.com/article/4472114-here-we-go-again

0 Response to "Mc Hammer Here We Go Again"

Enregistrer un commentaire